Your financial well-being depends on steady, tax-efficient income that lets you enjoy the things you care most about. Everything is interconnected, one challenge or change in one area could uncover an opportunity in another.

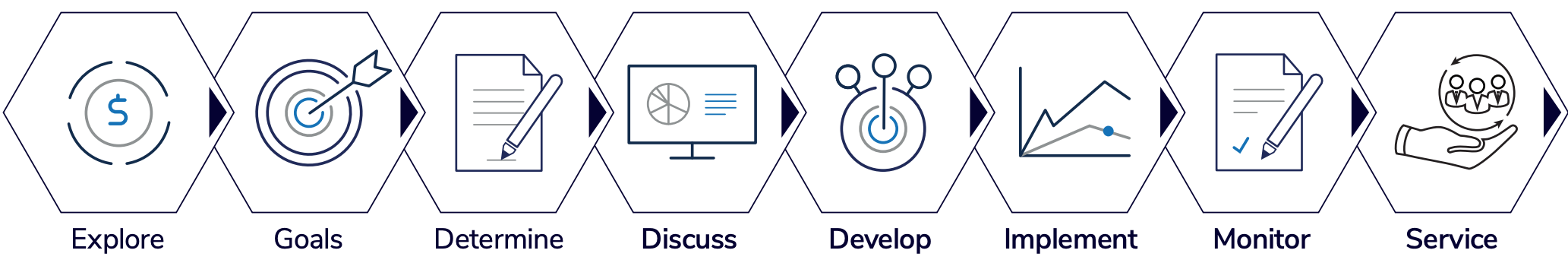

At Spence & Associates, we implement an 8 step process, creating your IG Living Plan.

1. Explore your current situation

It all begins with a conversation. We will listen and learn about you and your current financial complexities to help us customize our relationship with you. We will also explain the services we provide and establish our roles and responsibilities.

2. Clarify your goals and objectives

Every situation is unique. We take the time to explore and define all the life goals, financial aspirations and concerns you have for yourself, your business and your family.

3. Determine your time frame

Like a financial GPS, you need to know where you are now, where you are going and how long it will take for your journey. We will help you determine the time frame needed to retire with the peace of mind of not out living your money and enjoying all of your established goals.

4. Discuss your options

Your wealth strategy will be tailored to you and your goals. We provide effective, bespoke strategies to address both short and long-term needs.

5. Develop a Personal Financial Plan (PFP)

Using our advanced planning technology we are able to create a visual/interactive plan that allows you to see potential future outcomes, based on specific scenarios and assumptions. Working with you live within this software gives us the opportunity to explore all the “what ifs” of planning. This is an eye-opening process which provides clarity and peace of mind.

6. Implement the strategies

Managing significant wealth requires us to develop a customized asset mix that seeks to mitigate risk, seizes opportunities, and minimizes taxes. We are supported by a team of professionals with specialized expertise in tax and estate planning, securities, insurance protection, investment lending, business succession, corporations and more. We can manage your wealth through both a diverse and dynamic asset allocation approach that is overseen by some of the world’s top asset managers. We also often involve your own personal professionals to ensure a synchronized approach.

7. Proactively monitor and adjust

As life and family circumstances constantly change, we monitor and work closely with you to identify and present all relevant scenarios before adjusting your living plan. Life does not stand still, nor should your plan.

8. Service and results

We pride ourselves in providing exceptional client service. We are committed to continuing our education to make sure our team is always as current as possible. We build long term, nurturing relationships and treat our clients as family. We work hard to earn your trust and just as hard to keep it. Actions are measured by results.

Is your financial well-being on track?

Try our IG Living Plan Snapshot to find out. This straightforward online tool will help you assess if you’re on track to meet your goals, based on key dimensions of your financial well-being. From optimizing your retirement to preparing for the unexpected, answer a series of questions to provide an overall result out of 100. This tool also provides personalized recommendations to help create a comprehensive financial plan tailored to you and your family’s needs.